As tax season approaches one thing is clear for 2013: our friends and families will be paying more to the government one way or another.

Manitobans are faced with a bundle full of new or newly risen taxes and fees outlined in the provincial and municipal budgets. These increases range from many various sources and, by law, these taxes and fees all must be published and distributed in public documents for all citizens to learn about. However, there is a secret tax increase that the provincial government hasn’t reported, and it has actually been going on for quite some time.

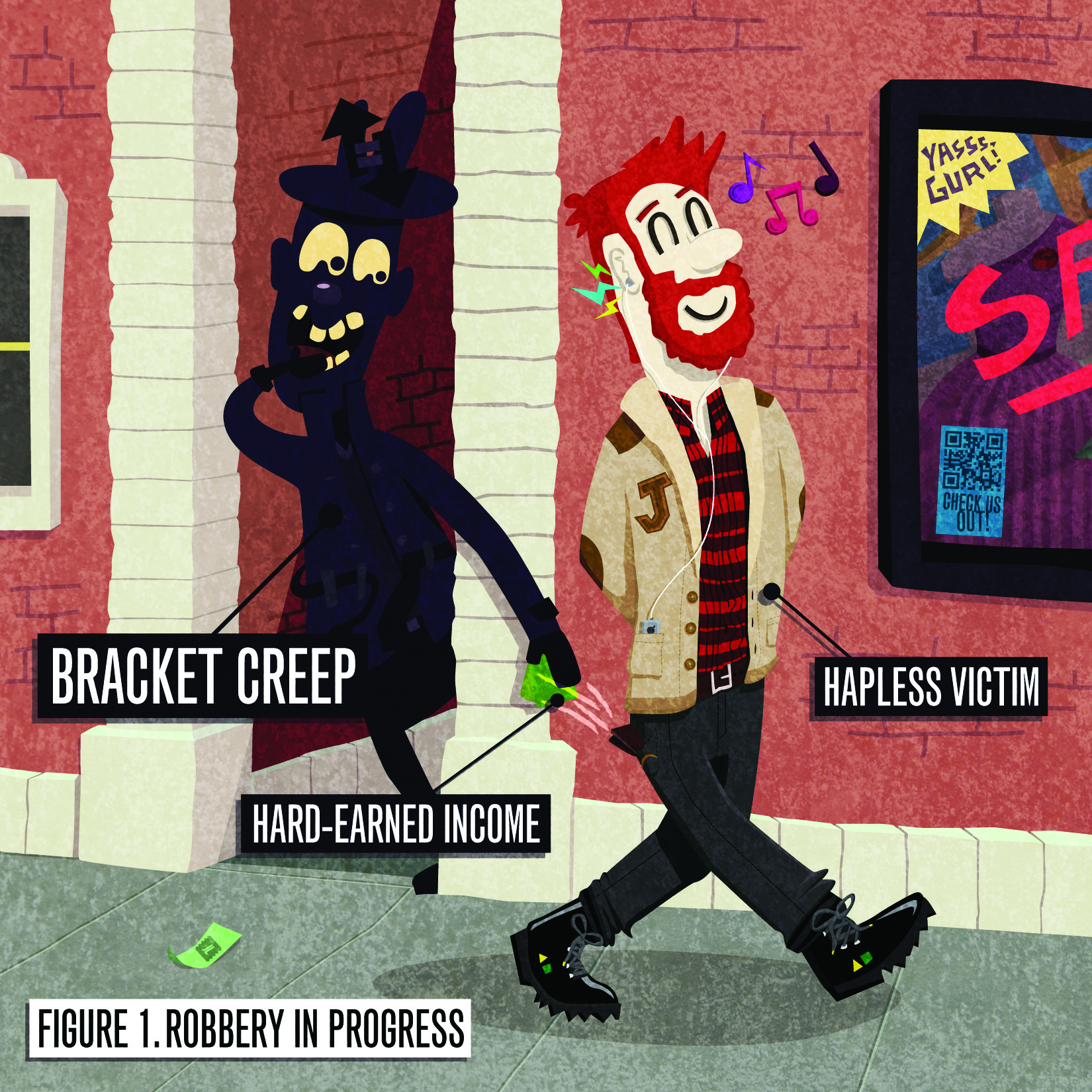

A report from the Canadian Taxpayers Federation shows that many Manitoban taxpayers pay higher income tax rates every year without even realizing it. This phenomenon is called “bracket creep,” and it is rooted in the beauty of inflation. Prices rise every year and so does your income; they all stay par to the growth rate of inflation. However, you aren’t getting any wealthier because your income is rising when everything else is too. The Manitoba government keeps income tax rates flat instead of adjusting the brackets to stay at the rate of inflation, meaning that you potentially could be pushed into a new and higher tax bracket for no valid reason.

Now how unfair is this? Your paycheck rises because the cost of living in general has increased and you end up having to pay more tax?

Manitoba has three provincial income tax brackets: 10.8 per cent on the first $31,000 of taxable income, 12.75 per cent on the next $36,000, and 17.4 per cent on the amount over $67,000. Each time your income grows due to the rate of inflation, you may be pushed into a new tax bracket, and thus will be taxed at a new rate. This happens even though your increased income never truly gains any new purchasing power.

Even low-income taxpayers can get hit by this. In 2009, the personal tax exemption rate was $8,134, and in 2011 it was again $8,134, meaning there was no adjustment to these exemptions even though prices and wages had gone up in that two year period. Thus, we are all losing out due to inflation regardless of what income bracket we are in. The report claims that since 1999 alone, bracket creep is costing taxpayers with incomes above about $40,000 an extra $156 each year in income taxes. For those with incomes above approximately $75,000, it’s costing you an extra $482 per year.

This is a substantial amount of money for many families. Our province’s decision to leave income tax brackets flat rather than adjust them is basically a decision to let income taxes increase every year on hardworking families.

Year by year Manitobans pay all sorts of taxes and are required to report all the income that one accumulates throughout the fiscal year. Hiding information isn’t really tolerated. Shouldn’t this work both ways? Manitoba taxpayers have every right to know what the government takes from us, as they have the right to know all the sources of your income.

This issue should be an easy fix, as many other provincial governments have already addressed this issue and have increased their exemptions and tax brackets to stay on par with the rate of inflation. This makes sure taxpayers don’t get the raw end of the deal.

Sadly, Manitoba, Nova Scotia, and P.E.I. are the only provinces that still allow for bracket creep to continue. It is disappointing that this secretive form of taxation exists, but I don’t want to completely discredit our government. Perhaps this additional revenue has gone to great use and it may be justified, but it was gained through a shady policy that shouldn’t have existed in the first place.

Unfortunately, Manitobans will have to pay higher taxes this year one way or another, hidden or known. But for the sake of achieving robust transparency and a trustworthy government, I think that 2013 should be the year for bracket creep to end.