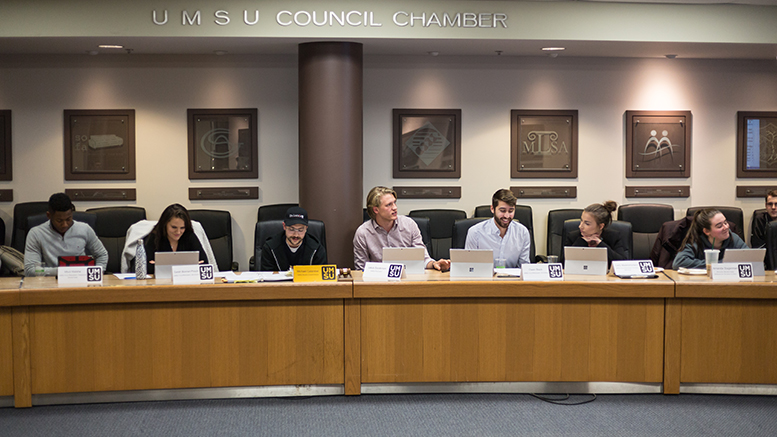

At the first board meeting since lobbying for students in Ottawa in early December, UMSU president Jakob Sanderson gave a presentation explaining the priorities of the trip — some of which left some at the meeting feeling “frustrated and disappointed.”

Sanderson, along with UMSU VP external Owen Black and governance research advisor Kyle Hiebert, spent Dec. 3-6 lobbying members of Parliament with the Undergraduates of Canadian Research-Intensive Universities (UCRU) on several priorities, including increasing support to Indigenous students, expanding Canadian undergraduate student research awards and eliminating the tuition tax credit.

UCRU is a collective of research universities that advocates for students from eight student unions across Canada.

The UMSU executives in attendance advocated in support of ending the federal tuition tax credit — estimated at $1.5 billion by UCRU — and instead recommended the Canadian government reallocate the funds to the Canada Student Grant Program.

At the meeting, Sanderson called this “maybe our most notable ask” and said the goal is to provide financial relief to low-income students.

“The issue with [the tuition tax credit] is that a lot of people don’t know about it, and so a lot of them end up not being claimed or sometimes they’re claimed by a parent or guardian, or funds are not claimed until a long time after graduation,” he said.

“The most consistent users of the tuition tax credit are generally those in high income brackets. And a lot of the time those in lower income brackets don’t have the income that’s taxable — so they can’t really take advantage of the tax credit — or a lot of the time people that have lower income are people that don’t have accountants, don’t have access to the information that people need to take advantage of the tax credit system.”

The Canada Student Grant Program provides non-repayable funding to both full- and part-time students with assessed financial needs.

“So that money can be used upfront by students, rather than being used later in the form of a tax credit,” Sanderson said.

Mohamed Soussi, the Muslim Student Association external executive who was in attendance as a student-at-large at the board meeting, said that as a student who relies on the tax credit, he is concerned students were not properly consulted by UMSU on what it lobbied for in Ottawa.

“I highly doubt any of the student body at large has any idea that UCRU even exists, or that we’re even a part of it,” he said.

“I don’t even think that any of them knew that Jakob actually went to Ontario and actually lobbied.

“I don’t think that anyone is actually up to date about anything on the actions of our own elected officials, other than the student board of directors — which for me is absolutely insane.”

Sanderson pushed back at the meeting, saying it was the responsibility of the UMSU board as elected leaders to make these decisions.

“I don’t think it’s ever bad to go to the students, but I also think that our board is our highest governing body, and I trust everyone here to be able to bring forward the concerns of the students,” he said.

Mature students’ representative Sharlene MacCoy — who said she was speaking as “both a student and a parent who’s putting children through university” and had some concerns with the impact of reallocating tuition the tax credit funds — also raised concerns, calling the effect of eliminating the credit on families “actually very damaging.”

“I’m curious if you thought of the impact that removing the tax credit would have for families,” she said.

“The magical number to get a grant isn’t as high as you would think.”

In Canada, the family annual income cut-off for full-time students with dependents — a dependent qualifying as a person 12 years of age or under, or 12 years of age or older with a permanent disability — to be eligible for a student grant is $114,017 for a family of four.

Sanderson said that while the executive was “sympathetic” to this issue, UMSU and UCRU’s concerns are that all the funds available through the credit program are not being used.

He said the grant program would benefit students in the lowest quintile of household income.

“I guess my response to that would be, yeah, [the eligibility cut-off] isn’t an absurdly high household income, but there are a lot of students also that have household incomes significantly before [that number] too, and those students often are seeing almost no benefit,” he said.

UCRU recommends the Canadian government implement these changes because “tax credits are no longer an effective tool to financially support low-income students.”

According to the list of UCRU briefs, providing grants upfront “will reduce the sticker cost of education, thus lowering debt levels and better utilize the government’s current allocation of funding, while adding no additional expense to the federal budget.”

Soussi said he believed the idea would harm students in the long run.

“I did get a bit ticked off emotionally that Jakob would say that it was for ‘affordable education,’” he said.

“That is the opposite of affordable education in my view. To take away money from someone and tell them ‘This is for affordable education’ does not sit well with me at all.”